There is simply no doubt that banking, along with much of the consumer facing retail world, is at the other side of the inflection point already. More than that, fintech is disrupting almost every point along the way.

With the right strategy and focus on innovative customer experience offerings, banking can still grow significantly through digital channels. The financial world is beset by startups eager for a slice of the pie, but as yet, it still has not fully consumed the core of banking. But the fintech industry is feasting well into the edges, enjoying bits of insurance, loans, financial management and a significant portion of the payments business.

Customers Want it Easy in Banking

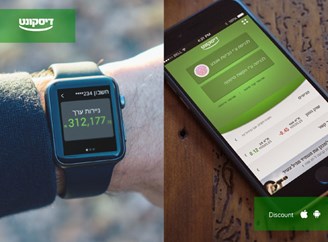

Banks need to win at digital in order to drive growth, retain existing customers and win over new ones. Customers just want banking to be easy, so much so that there has never been so few people going into physical branches.

Banks need to win at digital in order to drive growth, retain existing customers and win over new ones. Customers just want banking to be easy, so much so that there has never been so few people going into physical branches.

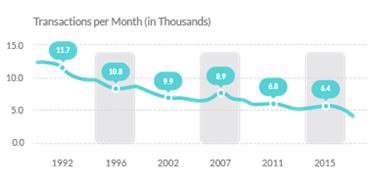

The physical branches are whithering, providing huge opportunities to continue innovating in the core digital banking space. Teller transactions are at the lowest point in a generation and the cost per transaction has skyrocketed. In recent surveys, two-thirds of bank customers are looking for easy digital experiences above all in choosing their bank. Less is more when it comes to branch visits.

In a clearly transactional relationship between the banks and it's customers, it has never been more important to advocate for the customer experience. The future of banking is a human face of digital consumer experiences. Getting the customer journey right is of paramount importance.

Banks need to win at digital in order to drive growth, retain existing customers and win over new ones. Customers just want banking to be easy, so much so that there has never been so few people going into physical branches.

Banks need to win at digital in order to drive growth, retain existing customers and win over new ones. Customers just want banking to be easy, so much so that there has never been so few people going into physical branches.